04.05.2020 – Special Report. Now things are getting uncomfortable: The Australian “Saturday Telegraph” has published an explosive corona dossier. It was obtained from the “Five Eyes” – the secret services of the USA, Great Britain, Australia, Canada and New Zealand. In it China is criticised – Beijing has endangered the countries of the world and tens of thousands of lives on its conscience. This increases the danger of a new trade war. Not only America could demand reparations from the Middle Kingdom or impose new sanctions. In the worst case, investors should prepare themselves for a wild ride on the stock market.

China did not care about the world

The report’s main accusations are that the Communist leadership knowingly destroyed evidence of the Corona outbreak, knew about the disease much earlier than it publicly admitted, and silenced critical scientists. The virus did escape from a Chinese laboratory in Wuhan. And ultimately, there is a possibility that the virus was altered by humans.

US Secretary of State Mike Pompeo told ABC that there was “overwhelming evidence” that the novel pathogen came from a laboratory in the Chinese city of Wuhan. And the Associated Press news agency reported that China had covered up the early extent of the virus to hoard protective equipment.

All traces lead to Wuhan’s laboratory

Already last week, analogous theses to the “Washington Times” were punctured. According to these, the US government assumes that either the Wuhan Institute of Virology (WIV) or the Center for Disease Control (CDC) in Wuhan is the epicenter of the outbreak. But in no case is the Huanan animal market, from which, according to the official Chinese version, the virus is said to have jumped from animal to human. By the way, the CDC is only a stone’s throw away from this “wet market”. Although there is no clear proof, there are some solid clues – see for yourself.

„Bat Woman“ and „Patient Zero“

On the one hand, Peng Zhou, the head of the Department of Bat Infection and Infection at WIV, conducted research on Ebola and SARS. His colleague Shi Zhengli worked on the bio-engineering of corona viruses and became known as “Bat Woman” because she set off to see bats in caves. The Wall Street Journal added that WIV researchers had captured infected bats in 2013. Their samples would have been forgotten in the laboratory until early this year. Already in 2015, “Nature” warned against this research on the bats, in the same year the USA stopped funding the laboratory. US diplomats had warned in several dispatches about the poor safety standards in the WIV, the “Washington Post” reported.

On 01 January 2020, both laboratories imposed an absolute communication ban on all employees. A few weeks ago, the vita of a laboratory employee named Huang Yanling was removed from the WIV website – maybe she was “Patient Zero”.

Incidentally, in a television discussion, the scientist Luc Montagnier suspected that the corona virus had been altered in the laboratory for research into AIDS and had escaped. Indian experts had also drawn such conclusions, but their research paper had been withdrawn under pressure from China. This did not work for him. The man is not just anybody – he is a Nobel Prize winner and discoverer of the HIV virus.

Anger in Washington

Last week US President Donald Trump had already rattled his saber. Firstly, Bloomberg reported that Trump was considering banning state pension funds from investing in Chinese companies that were a risk to national security. Specifically, the Trump administration is planning an executive order against The Thrift Savings Plan. This pension fund is allowed to invest 50 billion dollars in a fund that replicates the MSCI All-Country World Index. This would stop a lot of money going to the Chinese stock market.

Reparations or tariffs

Asked about reparations and a comment in the “Bild” newspaper, Trump said that America could demand far more money than the equivalent of 160 billion dollars. Asked whether it was about punitive tariffs or simply the default on paying back debts to China, Trump told journalists, “there are many things I can do. We are curious to see whether US government bonds will soon become a weapon in the trade war.

In an interview with Reuters, Trump said that China wants to see him lose in November. China denied. But what we can very well imagine for example, Hunter Biden, son of challenger Joe Biden, co-headed BHR Partners, an investment firm founded in 2013. With the blessing of the Communists and financial support from the Bank of China and China Development Bank, BHR brought Chinese companies to stock exchanges in the West – a pretty license to print money. At the time, Dad Biden was the Vice President of the USA. It looks very much like the Biden clan was bought to allow China to flood America undisturbed with cheap exports, unfortunately, unfortunately, many US jobs were destroyed.

What did Beijing know when?

Whether the Chinese leadership actually hid the Corona outbreak to save face, or whether the Communists even wanted the virus to travel around the world to weaken other countries as well, is unclear. The fact is that the hardliners have already moved on to verbal retaliation. According to the state-run “Global Times”, an American soldier carried the virus to Wuhan. “Patient Zero” is said to be a chauffeur who participated as a cyclist at the Military World Games in Wuhan in October 2019. The actual origin is said to be the US laboratory in Fort Detrick in Maryland, which was closed in July 2019. This raises the question why the virus did not appear on the US East Coast before October.

Away with the dollar

Another Chinese cadre also upgraded verbally. The head of the Shanghai Gold Exchange (SGE), Wang Zhenying, called for an international super-currency to put the dollar down, according to Reuters. The Federal Reserve will sooner or later sink the dollar in its reaction to Covid-19. Meanwhile, some forecasters believe a return to the gold standard is possible.

How the stock market will react

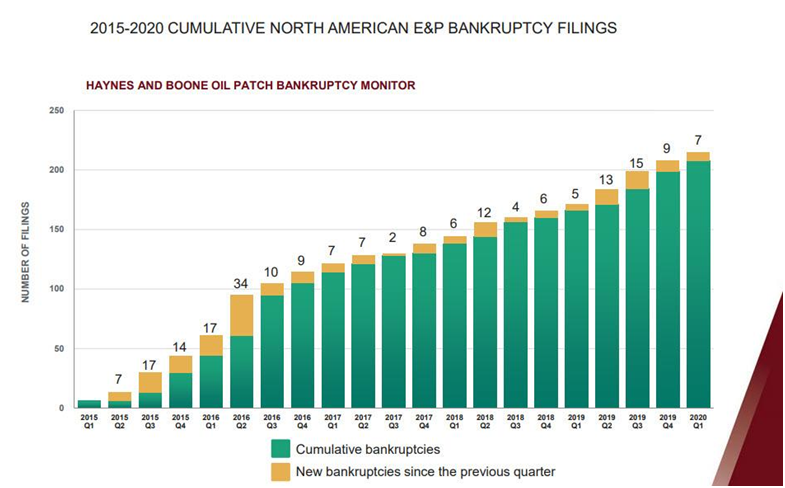

Our conclusion: The above-mentioned secret service reports have not been given to the press without reason – something is brewing here. If things do indeed escalate into an open trade war, the yuan, Chinese stocks, Wall Street, DAX and Co. are likely to find themselves on the short side. Ditto oil – the global economy will then be slowed down further, which will result in a decline in consumption. Just remember how the market trembled whenever the trade talks threatened to fail.

The Australian stock market and the Australian dollar could also run into turbulence. The Chinese ambassador Cheng Jingye threatened Australia once before on Sky News because of the investigations of the “Five Eyes” with consequences for tourism and exports. By the way, the above mentioned scientists Peng Zhou and Shi Zhengli have been working in Australian laboratories, which is now being investigated more closely.

Armaments stocks are likely to react long – the Cold War could soon become hot. Which in this case could also push up the price of oil. In addition, gold should rise, as always the safe haven in times of crisis.

The Bernstein Bank wishes successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.