12.03.2020 – Special Report. Corona and no end in sight: The stock markets continue to plummet, investors are desperately waiting for a decisive political response. Because of Covid-19, the world may stagger into total deflation. The current bear market could be worse than the Great Crash of 1929, and the vehemence and speed of the crash signals that we are currently dealing with something very special.

Always new bad news

It’s always worse: US President Donald Trump has cancelled all flights from Europe to the USA for 30 days. He made no concrete statements about a possible aid program. The futures continued to plunge after Wall Street had already gone into a low level flight before anyway. And yesterday Angela Merkel (CDU) finally spoke to the people. 60 to 70 percent of all people in Germany could be infected with Corona. Apart from the appeal for solidarity, there was no massive stimulus here either.

We had already reported a similar tenor in “Atlantic” two weeks ago. There Marc Lipsitch, Professor of Epidemiology at Harvard, said that corona “will ultimately not be containable” – the virus cannot be contained. In the coming years, 40 to 70 percent of the world’s population will become infected with Covid-19. Meanwhile, the US television station NBC reported that Brian Monahan, the doctor responsible for Congress and the U.S. Supreme Court, had spoken plain language behind closed doors: He said that there are between 70 and 150 million people in the United States who are infected with Covid-19. All hammer blows for the stock market.

Thinking the unthinkable

If the assumptions about infection rates prove true and no vaccine can be found, if people do not develop natural resistance and corona shrinks to a small, malignant flu, we can expect the global economy to be shocked for months, if not years. So it is time to think the unthinkable. We allow ourselves some thought games about the effects on the stock market. We will spare ourselves chart analysis, in times of panic it is ineffective anyway. The only thing that is clear is that there will always be small rallies of hope on the way down. And at some point all the many price gaps that have been torn open in the meantime will be closed again.

Best case: Short but severe recession

Most analysts currently only dare to imagine a short recession. No wonder, many only know the just finished eleven-year-long bull run in the Dow and see every bear market as a relatively quickly ended price correction.

JPMorgan recently capped its year-end target for the S&P 500 from 3,400 to around 2,300. Goldman Sachs under Chief Equity Strategist David Kostin now expects a price target of 2,450 points for the S&P 500 by mid-year, although the index could potentially rise to 3,200 again by the end of the year. Chief economist Torsten Slok told MarketWatch that it was still too early to get back into equities, as there was a lack of decisive political reaction. Companies or consumers would need money to spend it.

Medium Case: Prolonged agony

It remains doubtful that the economy will recover quickly in the event of a pandemic – this could take one or two years. And here is another interesting statement from the widely ramified Goldman universe. Another team, this time from Chief Global Equity Strategist Peter Oppenheimer, looked at all bear markets since 1835. The conclusion: a sharp bear market cuts prices between 29 and 57 percent.

Initially, the Goldmann team distinguished between “event-driven”, i.e. a bear market triggered by external influences, such as war. Such falls cost an average of 29 percent of the yield. After all, such stock markets, which were shaken by an exogenous shock, recovered within 15 months.

Crashes of up to 57 percent possible

In cyclical bear markets, the average decline was still 31 percent, the Goldman study went on to say. We think: This is partly true at the moment, because the Goldmen defined this as the end of an economic cycle, recession and a slump in profits. Only the rising interest rates do not fit.

But it gets worse: according to Goldman, structural bear markets have plunged by an average of 57 percent. Investment bankers see such structural crises characterized by financial bubbles, often followed by price shocks such as deflation. We do see parallels to the current situation here.

Goldman Sachs himself did not decide where Covid-19 should be placed – because Corona is a special case. Goldman analyst Oppenheimer commented, “We’ve never before entered a bear market because of a viral outbreak.” And this time it was not clear whether the countermeasures of monetary policy would work. After all, interest rate cuts could not take effect in a world where consumers are forced to stay at home for fear.

Worst Case: 1929 revisited – Dow down by 85%

We’re going to go one better. Worst-case scenario: The virus becomes more widespread, mortality rates rise sharply. People are shutting themselves in their homes because of the new plague. Governments are either too slow to react, or not reacting at all. The result would be years of global recession, which would grow into an unprecedented deflationary shock. Like this: Banking crisis of 2008 plus global economic crisis plus unprecedented mega-epidemic. Including a possible harsh political upheaval plus interim erosion of public order. In short: a complete collapse in politics and the economy.

Source: Finanzmarktwelt.de

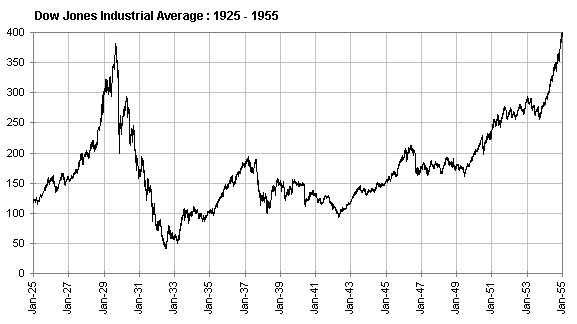

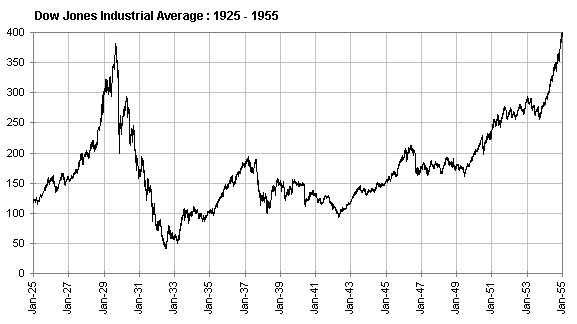

The worst-case scenario that seems most comparable to this is the Great Depression of 1929, when the Dow Jones had sifted through from its high of over 350 points before Black Friday in October 1929 until the end of 1932. Only more than 20 years later did the US leading index return to its old highs.

Transferred to today’s Dow and its high at around 30,000 points, this would mean a drop to just over 4,000 points. It could also be more violent: For unlike in 1929, the impact of the disease on the health and welfare systems of many countries is still a burden on the national economies today. However, in this case the stock market is likely to turn south for several years. If the bull market lasted for a decade – why shouldn’t the bears rule for just as long? Just as well that they can go short when you trade CFDs.”

A New Deal is needed

Our conclusion: Only a gigantic New Deal will help against a potentially gigantic system shock – best coordinated by the G20 states. Massive economic stimulus programs plus government support, perhaps combined with helicopter money.

In an angry article, Michael Every from Rabobank summed it up similarly. At first he criticised the lack of major stimulus in the USA. Then he gave two historical examples to denounce the current refusal of politics to act. First, the “Great Stink” of 1858 in London. It was not until a hot summer, when the stench of the Thames, which had become a sewer, became unbearable, that the administration took action – and London was given a modern sewage system that still functions today. Before that, politics had repeatedly delayed the mega-construction because of the weekly markets and the interference with business. At least the British acted at some point. In the Soviet Union of the 1970s, by contrast, the communist gerontocracy delayed overdue reforms – until the collapse.

And then the Rabobank expert at least made a commendatory reference to present-day Britain. He called Rishi Sunak, the young and energetic British chancellor. According to press reports, Sunak will soon present a stimulus package of 600 billion pounds over five years – the highest level of government money since 1955. And the rigid fiscal corset is already history: “As such, out the window go the UK’s Fiscal Rules. That would be a real relief for the beleaguered bulls on the stock exchange. The Bernstein Bank wishes successful trades.

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.