07.07.2023 – Do you believe in the energy transition? Then you should take a closer look at silver. At least, if it’s up to the bulls: Because according to them, the white metal will be increasingly needed in solar modules in the future. And with that, the price would sooner or later move north.

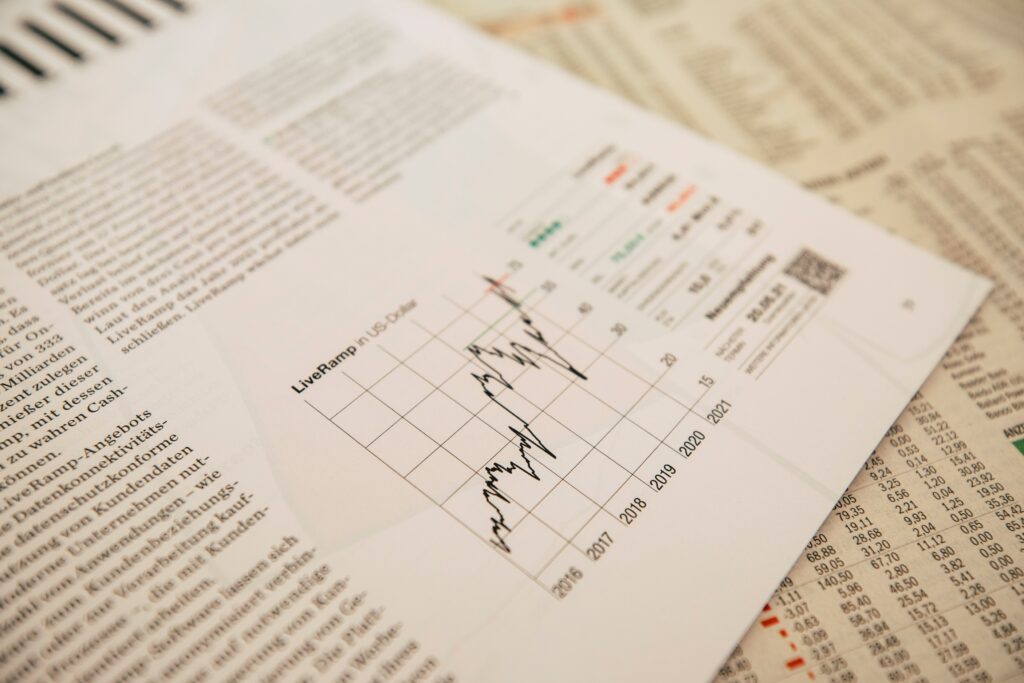

Recently, the price of silver has moved rather sluggishly sideways-downward, here the daily chart. This is due to the worldwide recessionary tendencies – silver is primarily an industrial metal. In addition, the fight of the central banks with higher interest rates presses the inflation. But perhaps the current level is a good entry opportunity.

Source: Bernstein Bank GmbH

Silver is used for this purpose: In coins and bars as a store of value and in jewelry. Furthermore in photography, the electrical industry, chemistry or in the pharmaceutical production – because silver kills bacteria. But silver is also used in batteries and in glass coatings, i.e. in mirrors – which brings us to photovoltaics.

Solar needs silver

Six months ago, the University of New South Wales in Australia pointed out that solar producers will probably need about one fifth of the annual silver production by 2027. By 2050, they say, as much as 85 to 98 percent of current silver reserves will be used in solar panels.

The advocacy group Silver Institute also reported that nearly 114 million ounces of silver were installed in photovoltaics in 2021, up from only about 51 million ounces in 2013. According to the report, the trend has continued: Estimates for last year are 127 million ounces. Of course, the word of a lobby group should be taken with a grain of salt – but it may still be true.

New solar modules

Especially since new types of solar panels are likely to be increasingly used, which consume more silver. The current standard is PERC: “Passivated Emitter and Rear Cell” reflect sunlight with a special coating on the back. A new, more effective type is TOPCon, which stands for “Tunnel Oxide Passivated Contacts”. In layman’s terms, the thin passivation layer is followed by a thicker layer of crystalline silicon, which is placed between the silicon wafer and the metal contacts. And then there are the new heterojunction modules, which consist of multiple layers of semiconductor materials with different energy levels. According to Bloomberg, PERC needs about 10 milligrams of silver per watt, but TOPcon needs 13 miligrams. And for heterojunction, it’s 22 milligrams.

The Silver Institute sees demand from industry rising by 4 percent this year, while production is expected to increase by only 2 percent. Silver supply is also running in the slipstream of the global economy: Four-fifths of the precious metal is extracted as a byproduct in the mining of lead, zinc, copper or gold. However, mining companies are reluctant to develop new projects, partly because of ever more stringent environmental regulations. And if they do, the new output can take a decade.

We are curious how the situation with the white precious and industrial metal will develop further – Bernstein Bank keeps you up to date!

_____________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7