16.03.2020 – Special Report. Now the Bitcoin bulls are digging in their heels again: The first exchange-traded fund for BTC in the USA is about to be launched. Another important step towards acceptance in the broad financial market. Especially as the dollar continues to be blithely destroyed by vast amounts of fresh money. And with a Norwegian oil billionaire and even Goldman Sachs jumping on the bandwagon.

Index funds in the USA and Canada

Grayscale Investments is said to have already hired an entire team for the launch of the first authorised BTC ETF in the US, as Bloomberg reports. Grayscale has already offered the Grayscale Bitcon Trust, which buys or sells BTC at some point and does not directly follow the price; indirectly, an investment was already possible via Square, Tesla and Silvergate. Apparently, the US regulators have also received ETF applications from VanEck Associates Corp. and Bitwise Asset Management. Canada was quicker: the second ETF has just been listed on the Toronto Stock Exchange, and a third is already on the way, as Coindesk reports. CI Global filed an application for an Ether ETF in Canada in February.

Such index funds should further fuel interest in the e-currency. Because if the central banks and governments of the world ban Bitcoin and co. at some point, you can get out of the investment – albeit at falling prices, but still. Those who are invested in BTC are out of luck in the event of a trading ban.

More supply in Germany

Incidentally, Deutsche Börse has also recently expanded its offering for trading in cryptocurrencies. In future, investors will be able to trade financial products that are physically backed by Ethereum and Bitcoin Cash. Specifically, two ETPs from the provider 21Shares, which already trades a Bitcoin ETP and a Short Bitcoin ETP, will be included. The assets of the new ETPs exceed $100 million, according to 21Shares. The 21Shares Ethereum ETP is fully collateralised with Coinbase as an independent, regulated custodian for institutional investors, it said. The exchange has already offered such a product for bitcoin since June 2020.

Oil magnate immunises himself against financial crash

Moreover, the Norwegian oil billionaire Kjell Inge Rokke also believes that cryptos are the best defence in the event of disruptions in the financial industry and central banks. And just like in the oil industry, such a violent crisis will come – it is only a matter of time. His investment firm Aker ASA, which controls oil and oil service companies, is now setting up a subsidiary called Seetee – to trade BTC. The start-up capital is $58 million. To his shareholders, Rokke wrote that Bitcoin could very well plunge to zero – but it could also become the core of a new money architecture. It is not impossible that BTC could one day be worth millions of dollars.

Gutting the Greenback

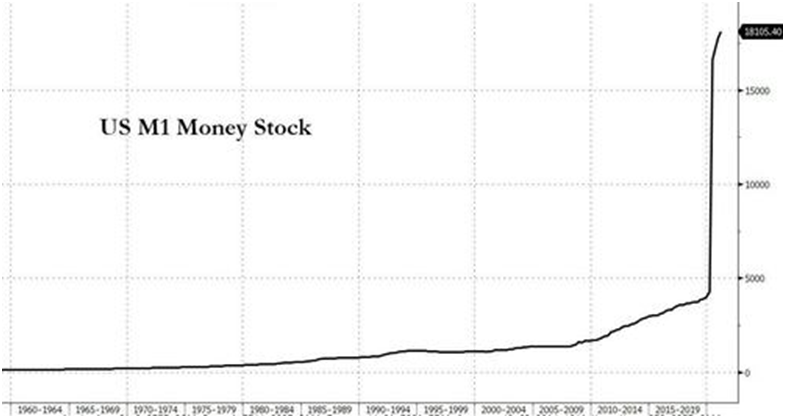

Anyone who looks at the development of the money supply in the US likes to believe such forecasts. The dollar is being increasingly thinned out. And the chart below does not even include the new $1.9 trillion aid package. Michael Snyder of The Economic Collapse Blog said: “It took from the founding of the United States to 2020 for M1 to get to 4 trillion dollars. And then it took about one year for M1 to go from 4 trillion dollars to 18 trillion dollars.”

Of course, the floods of money will find their way into tangible assets whose price can only be manipulated with difficulty or not at all by the central banks. So in real estate, precious metals, land, commodities – and e-currencies.

Goldman builds trading desk

Finally, Goldman Sachs is working on rebuilding its cryptocurrency trading desk. The situation is different from the 2017 BTC bubble – there is strong institutional demand and from private banking clients, Matt McDermott, Global Head of Digital Assets at Goldman Sachs Global Markets Division, said in a podcast.

The example of China

Our conclusion: The acceptance of BTC is increasing. But the danger of a government ban remains. Unless, of course, the world’s rulers deliberately want to maintain a kind of reservoir for the floods of newly created money. This is what China once did under Deng Xiao Ping: With the economic reforms, the People’s Republic cranked up inflation. And allowed gold ownership again. Plus the private purchase of real estate. Just like in Russia during the oil boom of the early Putin era, a lot of money flowed not only into consumer prices, but also into the stores of value: gold, real estate and land. And also into the stock market. Moscow and Beijing thus let money flow out of the real economy and avoided the impoverishment of the masses and a revolution through rising food prices; at the same time, they created a middle class that built up wealth and is loyal to the rulers.

So: Maybe the US and Europe will also go this way – and legalise BTC once and for all. Which should shoot the price towards the sun. Bernstein Bank wishes you successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.