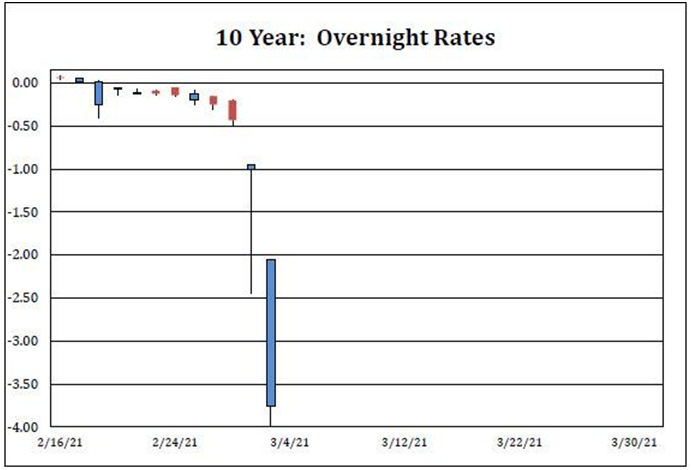

04.03.2020 – Special Report. Caution, the Federal Reserve is likely to intervene soon: A historic event has taken place on the repo market. For the first time, the interest rate for overnight lending of ten-year US government bonds has fallen to minus 4 percent. In other words: nobody wants Treasurys, even if they receive money. Presumably the Fed will strike soon – and thus also help the stock market.

Sell-off in US bonds

Complicated mix on the financial market – US government bonds had recently also put pressure on equity trading. Fear of rising inflation led investors to sell US Treasurys on a large scale. Falling bond prices mean rising yields – as a result, inflation expectations pushed up real interest rates, which recently approached the 1.5 to 1.75 percent mark. This makes debt more expensive for young companies and has just weighed on the Nasdaq Composite. And this rising nominal interest rate is also eating away at wage growth rates, causing unrest among the people and eroding purchasing power. And thus slows down the economy.

The repo craze rages

So nobody wants bonds. There is another crazy corollary to this situation: according to repo guru Scott Skyrm of Curvature, the 10-year US Treasury bond just traded for minus 4 per cent in the repo market. That is a record level that the Federal Reserve cannot let go unobserved. In other words, lenders theoretically had to force money on buyers in order to get someone to take the Treasurys. Short-term loans are traded on the repurchase market – but no one is currently buying. Skyrm said that short demand had now outstripped supply. Golman Sachs had also just said that there was zero liquidity on the buy side of Treasurys. The situation resembles the peak of the Covid crisis last March.

ZeroHedge classified the matter this way: “This is important because it means that the imbalance in the bond market is no longer just a fundamental bet by traders expecting inflation: there is also something profoundly wrong with the actual market structure itself so much so that if left unchecked it could lead to catastrophic consequences for the world’s (once upon a time) most liquidity market. “

The Fed has registered the matter

We suspect that it is only a matter of time before the Fed causes a massive short squeeze in the bond market and thus catapults share prices upwards. Fed Vice Chairwoman Lael Brainard, who is being discussed as the new head of the Fed, just said in a virtual speech to the Council on Foreign Relations: “I am paying close attention to market developments. (…) Some of those moves last week, and the speed of the moves, caught my eye.” Bloomberg added that the sharp rise in 10-year yields had fuelled speculation that the Fed would intervene because the higher real interest rate could choke off the economic recovery. Presumably, the Fed will shift bond purchases to longer-dated paper, he said. We suspect: That could mean a shopping spree in the ten-year. And trigger a massive short squeeze, pushing up Treasury prices, lowering real interest rates and fuelling the stock market.

Trading opportunities ahead

So here’s our urgent warning to all CFD traders: the Fed will not sit idly by in the face of the historic imbalance in the repo market and the ongoing sell-off in bonds. Perhaps it will already do so today when Jerome Powell speaks at a virtual event of the “Wall Street Journal”. Perhaps only with a time delay to surprise the market and thus warn speculators for the future. But there should be an intervention by tomorrow at the latest – because it would be irresponsible to let the market go into the weekend with interest rate fears running rampant. If, contrary to expectations, the Fed does not act, the bond market and Wall Street will crash. Fabulous times for traders. So be sure to keep an eye on the news – we’ll stay on the ball for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.