12.12.2019 – Special Report. Next week it will be exciting: The Repocalypse of September could be repeated. And also the December bear market on the stock exchange from last year. Only far worse than before. Because if a financial market legend is right, many banks will use cash to buy bonds. Which will dry up the interbank market again. And in the end it will force the players to sell out. Only the Fed could stop the disaster with a fourth quantitative easing.

Countdown to QE4?

Zoltan Pozsar is not just anybody. The Hungarian is considered one of the most important architects of the modern repurchasing market and has worked for the New York Federal Reserve and the US Treasury. He has just published a highly complicated brand letter for his current employer Credit Suisse. He titled his newsletter Global Money Notes #26 “Countdown to QE4?” Put simply, he warned of a worst case on the financial market – and a meltdown in the repo market, the interbank market for overnight credit. This could work its way up to Wall Street via the forex swap market and treasuries. And ultimately only the Fed will be able to stop the disaster.

Already this Monday it will be exciting

The starting signal for the apocalypse could already be fired on Monday. Then the quarterly tax date for the transfer to the tax office is due again – and the banks need cash, which they will then no longer be able to lend. We remember that the repo market last froze after 16 September. The interest rate exploded within minutes from around 2 to 10 percent. Three months ago, JP Morgan in particular had stopped lending. The problem: JPMorgan is one of the largest lenders in the market for short-term overnight loans. The Financial Times also noted a major strategic reorientation at the bank.

G-SIB and the Silvester-Crash

According to press reports, JP Morgan diverted 350 billion dollars into treasuries, triggering the cash drain. Such a step is being pushed forward by the regulators, of all people, who are calculating the so-called G-SIB surcharge on the last day of the quarter. This time on New Year’s Eve. G-SIBs are Globally Systematically Important Banks. The Basel Committee for Bank Supervision requires G-SIBs to hold a higher proportion (> surcharge) of safe reserves if they are heavily invested in risky assets. Since treasuries are considered safe investments, JP Morgan has just bought bonds on a large scale. Goldman Sachs is also seen as a big address that needs to reduce its GSIB surcharge.

And this could trigger a devastating dynamic at the end of the year: In order to lower the G-SIB scores, the few players with reserves could withdraw cash again and buy safe assets. According to Pozsar, the market is not yet pricing in such a scenario.

This time it’s much worse.

According to the Credit Suisse expert, there are three major differences at the end of 2018:

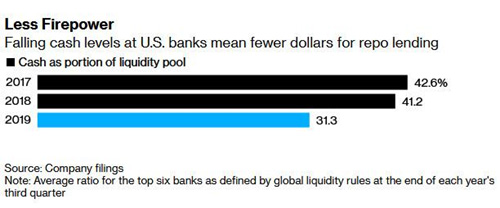

1) A year ago, major US banks still had cash reserves that they no longer had. Last year, banks’ cash reserves were 100 billion dollars higher, according to the financial blog ZeroHedge. All in all, the banks’ fire power had fallen drastically.

2) At the end of 2018, according to Pozsar, a fall of 20 percent in the Equities had reduced the G-SIB score – but not this time. We would like to remind you that the stock market has been marking new all-time highs lately. Higher share prices also mean a higher G-SIB score.

3) Last year the banks had still invested their reserves in complex trades such as FX swaps, whereby last year the repo rate on 31 December shot up to 6.5 percent of this. If there are no reserves left, there will be no fresh liquidity through currency swaps. And the repo rate could once again run off from the underlying by around 2 percent to undreamt-of highs.

Here comes the crash

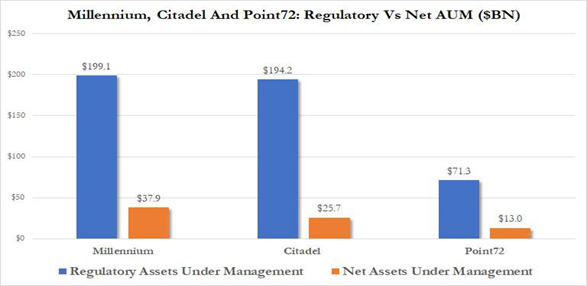

And that threatens the repo market. According to ZeroHedge, one of the strategies of large hedge funds is to buy US Treasuries and sell derivative contracts such as interest rate futures in order to take the arbitrage. The problem is that large hedge funds like Millenium, Citadel and Point 72 get their margin from the repo market. But if liquidity were to dry up, these players would have to sell their holdings urgently. The Bank for International Settlements has also just warned that the US repo market is mainly dependent on four major banks. And when the banks froze their money in September, the Fed suddenly stood in front of several LTCMs. Let us remember: the hedge fund Long Term Capital Management threatened the international financial system with its imbalance in 1998.

Double strike against the market

The bottom line is that the market could soon be hit twice. In Pozsar’s worst-case scenario, market players buy too many collaterals such as treasuries and do not make cash reserves available to the interbank market. On the other hand, addresses that urgently need cash must get rid of their stocks. According to Treasurys, stock reserves are the big sales candidates. We think: Or some funds or banks may tip over.

Does a big bank want the crash?

According to Pozsar, should the Fed lose control of the overnight repo rates shooting off again in a cash drain and the crash begin, it can only do two things: First, it can encourage foreign banks to engage in FX swaps in order to pump fresh money into the market. Or secondly, buy up US government bonds now. According to Pozsar, only this second option will work and ultimately be nothing but a QE4. The devilish thing is that Pozsar reports that at least one major US bank is plotting a collapse of the cash market by mispricing in the forex swap market to force the Fed to QE4. Thus, according to Pozsar, buying US Treasuries is nothing other than a legal frontrunning strategy.

The Fed is alarmed

And if that all seems to be unworldly to you, then here are two little clues: Wall Street takes the matter very seriously. In response to a journalist’s question yesterday, Fed Chairman Jerome Powell replied calmly but surprisingly: “The Fed is also open to coupon purchases. That would be a novelty. And another look at history: on 5 September 2008, the repo market in the USA froze completely to a halt. Ten days later Lehman Brothers was history and the world slid into a gigantic financial crisis. This September, the Fed reassured the situation through repo auctions – the question is whether this will continue if really everything is worse than before.

Our conclusion: Whoever follows the warnings of repo pope Pozsar will subito invest at least part of his reserves in short positions on US indices as well as the DAX or Treasuries. And the money will be shifted into long positions as soon as the Federal Reserve really starts a QE4. Anyone who believes that the Fed will prevent a liquidity crunch in advance, for example by intensifying repo auctions, or that Poszar is wrong, will lean back and relax.

The Bernstein Bank wishes you successful trades!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.