13.01.2023 – Back and forth on the financial market: Inflation in the USA is cooling off. Investors are betting on an end to interest rate hikes in the U.S. because of new Consumer Price Index (CPI) data. But the Federal Reserve is quickly putting the brakes on the buying mood.

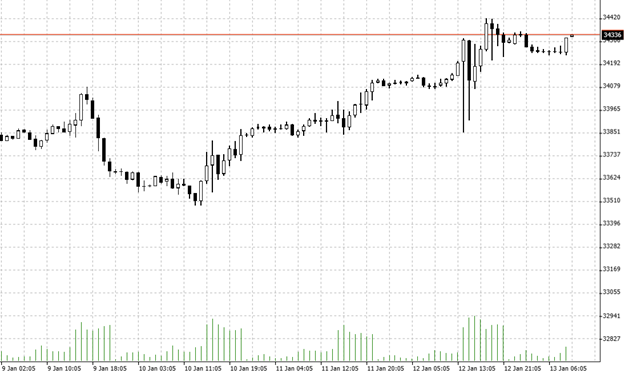

What happened: Yesterday, the new CPI data arrived. In December, inflation in the U.S. fell for the sixth month in a row. To be sure, year-on-year inflation is still hovering around 6.5 percent. But in November, it had still been at 7.1 percent. The market reaction in a nutshell: stocks up, Treasuries up, oil more expensive, dollar down. The Dow Jones, for example – here the hourly chart – had already gained before the data, then analysis and doubts set in, now the index has regained its footing. The other major U.S. indices look similar.

Source: Bernstein Bank GmbH

The “Wall Street Journal” just summed it up on its website: “Markets Are Locked in a Game of Chicken With the Fed. Investors are betting the Fed will cut interest rates as early as the second half of the year. The central bank says otherwise.” In fact, there is still a lot wrong with inflation. For example, falling energy prices are primarily responsible for the decline, but prices for services and rents continue to climb.

The Fed puts the brakes on

Accordingly, some monetary watchdogs spoke out. Patrick Timothy Harker, president of the Federal Reserve Bank of Philadelphia, said the Fed is prepared to raise interest rates a few times in 2023. To be sure, he said, it is time to move to 25 basis points. However, achieving the 2 percent inflation target is quite difficult, he said. In his view, the fed funds rate should remain above 5 percent. Currently, the fed funds rate is between 4.25 to 4.5 percent.

From the St. Louis Fed, James Bullard reported an interest rate above 5 percent is the lowest level the Fed needs to aim for to tame inflation. Thomas I. Barkin, Richmond Fed chief, added that the latest data are a step in the right direction, but the central bank still has work to do.

On the one hand.

Many brokers now expect the Fed to raise rates by only 25 basis points in February. However, analysts at Capital Economics commented: “But the Fed isn’t going to stop raising interest rates until it sees accompanying evidence of an easing in labor market conditions and wage growth. It will be a couple more months before that evidence is also irrefutable.”

Our conclusion: Perhaps the Fed’s orchestrated statements are only intended to curb the buying mood in order to prevent an excessive bull market. After all, that would create social dynamite: Prices are still rising and people are feeling that they can afford less and less. A rally on Wall Street would be poison for the government. From the verbatim reports, we read that the Fed will only pause above 5 percent – how high above that is the loaded question. Wall Street is likely to price in these expectations and see itself near the end of the tightening cycle. However, much will depend on the current reporting season – we’ll keep you posted.

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7