07.02.2023 – This is real power: Jerome Powell steps up to the microphone and the world holds its breath. At least, the financial world does. If the head of the Federal Reserve doesn’t play the hawk, rates are likely to fizzle upward. If he does, interest rate fears could return.

Today, things will get exciting again: stock market participants are hoping that Powell’s appearance at the Economic Club of Washington will provide further and more concrete indications of the future course of monetary policy. The question is whether the master of money takes the strong U.S. labor market report from Friday as an excuse to stress, again the topic Tightening. Many brokers in the market are already hoping for rate cuts. But the economy in the U.S. is humming, which should further fuel inflation. And that’s exactly what the Fed doesn’t want.

Risk of overheating

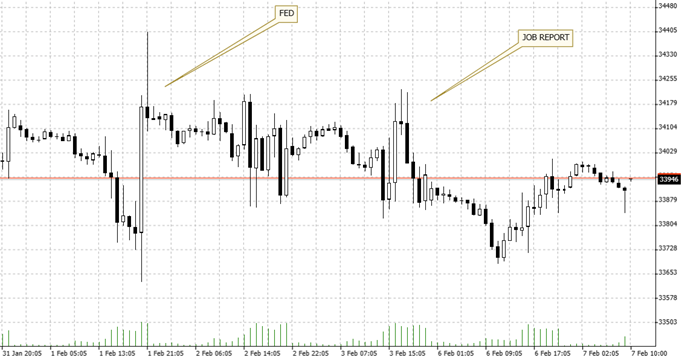

Indeed, Friday’s data point to economic overheating and a tightening of the wage-price spiral: the U.S. economy added 517,000 jobs in January, while analysts had expected only 188,000 new jobs. “TheStreet.com” commented that the data showed a strong rebound in the service sector. Very nicely you can see the nervousness in the hourly chart of the Dow Jones – the reaction to the respective events, first the Federal Reserve’s interest rate decision, then the labor market report – speak volumes.

Quelle: Bernstein Bank GmbH

The market’s caution is only understandable, judged Sinead Colton Grant, global head of investor solutions at BNY Mellon Wealth Management on CNBC yesterday. “I think the market is in a reassessment mode, and that’s why you see markets pull back a little bit, certainly post the jobs report, and we’re seeing a little bit more today.” Saxo Bank commented that the market had recently priced in only one more rate hike, but now the focus is shifting to whether there will be more.

Disinflation or tightening?

That is also the question today, as the oracle of Washington speaks of the topic of interest rate hikes. Will Powell continue to emphasize the theme of disinflation, i.e. a tightening of inflation? He did that last week at the press conference on the moderate rate hike. Or will Powell now focus again on even further tightening? It’s quite possible that he wants to take steam out of the stock market with this. We’ll know more around 12:40 p.m. Eastern Time. But be careful: It’s quite possible that some facts will leak into the market in advance.

As you can see, you won’t see anything for a while. As always, the fog billows over the trading floor around an important Fed meeting. Every half-sentence counts,professional and retail traders will dissect every single word carefully – they hang on Powell’s lips. If, contrary to the old Fed rule “don’t trade around the Fed”, you do want to enter the ring, we wish you every success. It remains to be noted that there are other influencing factors on Wall Street with the earning season. Whether long or short – Bernstein Bank wishes you successful trades and investments!

__________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7