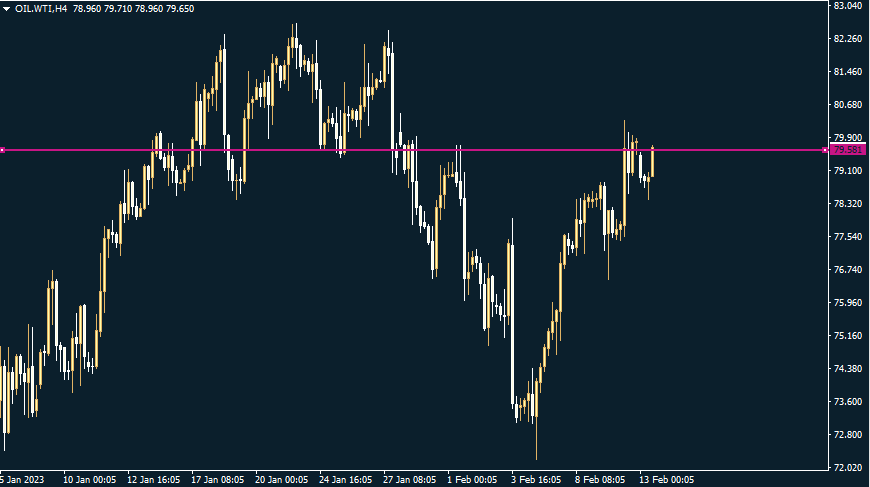

24.02.2023 – It’s not going to work: Elon Musk disappointed investors at Tesla’s Investor Day. Most investors had been waiting for a clear strategy in the lower price segment. Or even for the presentation of new, low-priced models. In vain. The stock took a dive.

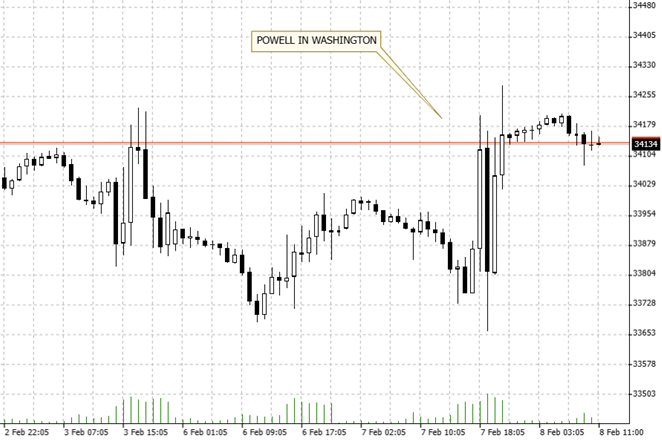

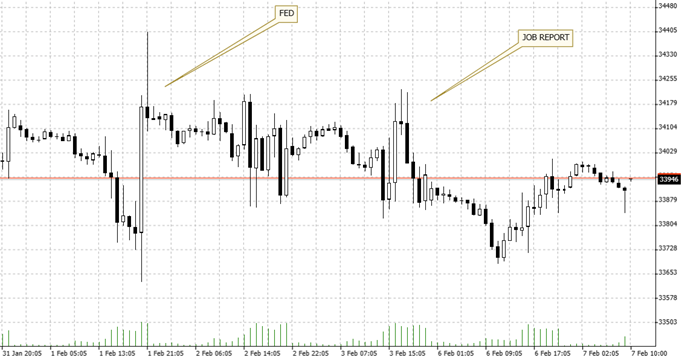

This is what bull frustration looks like: The Tesla share slid towards the south, here the view of the four-hour chart. It had risen in anticipation of the investor day. Musk gave little concrete information in Austin, Texas. Analysts also waited in vain for the new financial targets for the current fiscal year.

Source: Bernstein Bank GmbH

Tesla’s share price has roughly halved since its November 2021 high; after all, the stock has rebounded strongly since the beginning of the year. The most important reason for this is Musk’s abandonment of the chief executive post at Twitter – Tesla urgently needs a driver who is fully focused on the post. And doers to implement all the ambitious plans.

Hoping for the e-car for the masses

Musk stated the goal of halving the costs for the new generation of vehicles. To achieve this, new manufacturing methods are to be used in smaller factories. On Twitter, the manager explained that this would enable an electric car in the price range of $25,000 to $30,000. Tesla could then conquer the mass market with this.

Soon, Tesla wants to produce 20 million vehicles per year, which is ten times as many e-cars as now. That already sounds a bit full-bodied: Toyota, after all, the world’s largest carmaker by unit sales, sells only a little more than a million Corollas a year on the globe.

High costs

Hard to digest for the stock market was this fact: The cost of Tesla’s sales offensive could amount to around $175 billion. And another promise: The cyber truck, whose introduction has already been postponed several times, is to be launched this year.

Our conclusion: Perhaps Musk should concern himself more with German politics. Then he would learn that hollow words about the turning of the times are not yet facts and that action is needed to convince people – speech bubbles burst sooner or later. There is also the question of where all the electricity for the cool e-cars is supposed to come from – especially in hyper-green Germany, this is a big problem, because energy has to be ecologically correct.

However, the current setback could be a great entry opportunity if Tesla unexpectedly delivers what the market wants: cheap e-cars in large quantities. In any case, the stock is something like the global index for the transformation of the auto industry – and this is a theme we should keep an eye on. We are curious to see how it will develop – Bernstein Bank wishes successful trades and investments!

_______________________________________________________________________________________________________________________________________________________

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7