Gold 1750,94

|

EURUSD 1,1969

|

DJIA 32964,50

|

OIL.WTI 64,215

|

DAX 14661,50

|

|---|

We wrote extensively this autumn about the upcoming US presidential election. One of them dealt with the difference between the conservative and Democrat approach to the economy. And now, the Republicans’ worst nightmare is about to come true.

S&P 500

A reminder of what this was all about. Republicans have traditionally been in favour of tax cuts. This leaves extra money for businesses that increase production and create new jobs.

Democrats like to raise taxes in order to use them for social programs. Naturally, business doesn’t like this, production growth and service delivery go down. Unemployment gets a little higher. However, this is compensated for by those same social programme payments.

What has Donald Trump done during his years as president?

Apart from the many scandals that the whole world remembers, Trump did cut taxes in the US in a big way (although this is mostly remembered by Americans themselves). The economy grew by leaps and bounds on this cut and unemployment fell to multi-year lows. Of course, the pandemic turned everything upside down, but that is another story.

Joe Biden’s Business Horror

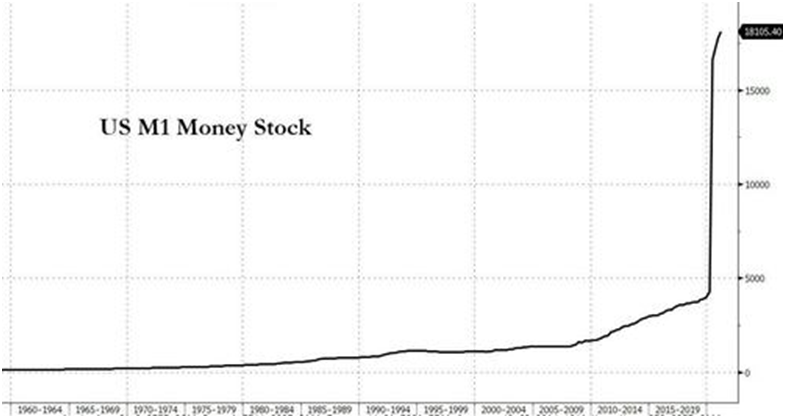

The other day a bill was signed into law for the biggest economic stimulus in history, to the tune of USD 1.9 trillion. This could lead to a real budget deficit of 15% in 2021. What is a budget deficit? It means that expenditures exceed revenues. And where does the revenue come from? That’s right, from taxes.

It makes perfect sense that Joe Biden’s administration plans to raise them. But the Democrats have decided not to be petty. According to leaked data, Americans are about to face the biggest tax increase in 30 years.

One of the main taxes shaping the budget is set to rise from 21% to 28%. It is a tax on profits paid by corporations. Added to this is an increase in tax rates on inheritance, capital gains, income of wealthy Americans, etc.

Who was doing something like this 30 years ago? Of course it was the Democrat president, Bill Clinton.

How does this threaten the US stock market, and subsequently the stock markets around the world? We invite you to ponder it today and tomorrow morning we will tell you what we think about it.

01.30 Australian Unemployment Rate for February

11.00 Bank of England Interest Rate Decision

13.30 US initial jobless claims for the week

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.