03.06.2020 – Special Report. After the crisis is before the crisis in Italy. The corona pandemic is perhaps the final cause that could push Italy out of the European Union and out of the euro zone. Because Italy is weakening, whether the gigantic aid package of the EU will be accepted is uncertain – perhaps we are facing an Italexit. This could have consequences for the euro and the continent’s stock markets. We shed light on the current background.

Referendum demanded for the Italexit

As the blog ‘InfoBrics’ just reported the political movement Italia Libera presented a draft constitution to the Supreme Court of Cassation on 27th May calling for a referendum for Italy to withdraw from the European Union. Gian Luca Proietti Toppi, a lawyer involved in the draft law, said that it was necessary to reach out to Italians and “open their eyes to the harmful effects of participating in a Union without a soul”, which operates on a purely financial basis. By submitting the 50,000 signatures required, he wanted to open a broad debate on the possibility of “leaving the cage of the EU and the euro”.

Getting out of the euro

An exit from the euro would therefore be the logical consequence after the italexit from the EU. Toppi stressed that Italy does not need any new debts, which would only leave the country at the mercy of international speculators. According to Statista, Italy’s national debt in 2018 was a staggering 2,300 billion euros, and in 2024 it will probably be 2,251 billion. Who is going to pay it back? The Italian central bank expects Italy’s gross domestic product to fall by 13 percent in 2020. And then an interesting side note for the financial market: Italia Libera has already commissioned experts to draw up a plan to secure the savings of Italians. This is probably meant to mean saying goodbye to the euro by exchanging it for a new currency. Or into gold.

Everything is different because of Corona

Even if there are always such considerations that come to nothing: There may be a chance of success this time. The Italians remember bitterly that Christine Lagarde, head of the European Central Bank, said on 13 March that the corona virus was an Italian problem. From then on, many Italians took down EU flags and raised Russian and Chinese flags instead.

What have open borders brought Italy? The EU’s most important achievement has now shown some disadvantages. Europe has not bothered about Italy being flooded by migrants from Africa – maritime borders are not secured. “Il Giornale” had already reported last March that Carola Rackete, who is venerated in this country as a saint in certain millieus, brought murderers and torturers to Italy. It is precisely such naive do-gooders who shape the image of the Germans in Italy.

Europe has also allowed tens of thousands of Chinese cheap labourers in northern Italy to push the domestic fashion industry to the wall – this is where the corona epidemic raged most.

EU funds a drop in the bucket

Interestingly, the referendum application was submitted at the very moment when the EU Commission announced its gigantic aid programme. The EU wants to place European bonds totalling 750 billion euros on the capital markets. From 2027 the debts are to be repaid – and this is to be done jointly by all EU states. Of this, 500 billion euros are to be paid out as non-repayable grants and a further 250 billion euros as loans to the states and companies most affected by the Corona crisis. A massive redistribution from North to South: Italy is in the lead with non-repayable transfers of 81.8 billion euros, followed by Spain with 77.3 billion euros and France with 38.8 billion euros. But how does that help in view of the mountain of debt described above?

There is also another big but: the EU will only promote investment if it strengthens climate protection, promotes digitisation and increases the resilience of the European economy. What is an Italian restaurant or a family-run hotel on the brink of collapse supposed to do with these ecologically correct bureaucratic hurdles?

Eurobonds put to the test

The European bonds now planned are de facto Euro bonds. It remains to be seen whether they will get through – the EU heads of government must approve the plan. This is to happen at the EU summit on 18 June. Austria and the Netherlands in particular are blocking the EU from taking on debt to finance transfers for needy member states. Both countries are demanding that recipient countries only receive loans but no grants. Which brings us back to the aforementioned rejection of new debt in Italy. So what is too much for some is too little for others.

Italexit as a challenge for the stock market

Our conclusion: Italy may have no choice than to leave the euro zone. Tourism as an important source of income in the national budget has been badly hit by Corona, the country is outdated, and new waves of refugees from Africa are likely to arrive soon. New debts are out of the question for many Italians. If there is no cut in debt, the country will be crushed by its euro burdens. So it seems tempting to withdraw from the euro and default on all euro-denominated government bonds.

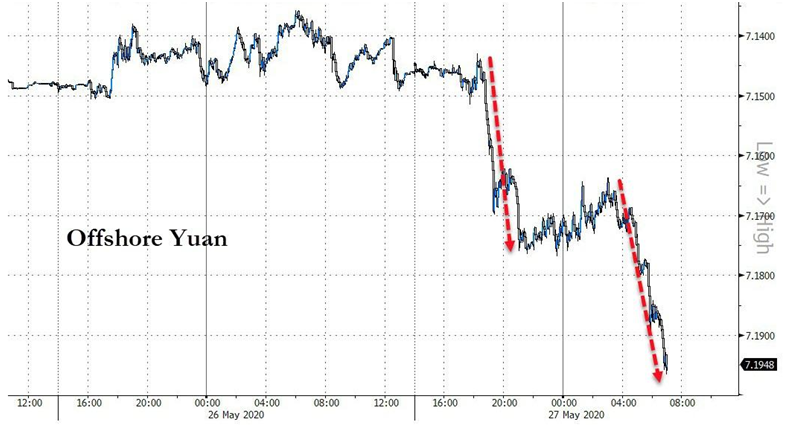

A default should cause the euro to shake. The question is what will happen to the approximately 490 billion euros that Italy has borrowed from the ECB via the Target 2 balances. Moreover, the crisis could spill over to France: according to figures from the Bank for International Settlements, the banks there held claims on Italian debtors of 286 billion euros at the end of 2019.

In such a scenario, the FTSE MIB share index is likely to initially go down on its knees. Above all banks and insurance companies – because, as the “Neue Züricher Zeitung” has calculated, Italy’s debt is initially primarily an Italian problem. According to the Banca d’Italia, domestic investors held around two-thirds of the debt, amounting to 2,444 billion euros.

But companies that export with a cheap new currency are likely to emerge as winners from the crisis. Italy bonds denominated in euros are likely to plummet to zero.

Needless to say, a successful Italexit would lead to turbulence on the major European stock exchanges, especially the DAX. Investors should therefore keep an eye on the issue.

The Bernstein-Bank wishes successful trades and investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.