01.04.2020 – Special Report. From the bulls’ point of view, the oil market has had its worst quarter ever. But the downward slide could continue. Because of the global deflation shock in the corona crash and the price war between Saudi Arabia and Russia. And above all because of Igor Sechin, head of Rosneft – he wants to destroy the American oil industry. Now the incredible has happened: The first US trader pays money to have his oil taken away.

A horrible quarter

Brent futures have just fallen to their lowest level in 18 years. In the first three months of this year, the price for the North Sea variety fell by around 65 percent – the worst quarter since 1990 according to CNBC. WTI lost 67 percent in value, the worst performance since contract trading began in 1983. The situation is unlikely to improve any time soon.

Full warehouses everywhere

Fatih Birol, head of the International Energy Agency, warned at an Atlantic Council event: “The effects of the glut will be felt for years to come”. Demand for oil is dropping by 20 million barrels a day. The trading house Vitol Group also quoted this figure. This would mean that both Russia and Saudi Arabia would have to stop production completely in order to bring the market back into balance. The Eurasia Group saw the limit in the world’s tanks reached in the middle of the year. Standard Chartered sees even less time: the oil tanks on the globe would be full in six weeks.

The industry is cutting capacity in the refineries. Exxon has just announced a reduction in processing at its Baton Rouge refinery, the second largest in the US. Royal Dutch Shell announced expense cuts of 20 percent or $5 billion, according to Oilprice.com. This means that the flood of oil is back to the producers.

Brent at $10

Goldman Sachs judged that Brent was more likely to be hedged against the fall in prices and could keep at 20 dollars because the supply chain was short – tankers could always drop anchor on the high seas. We think: If there are enough empty tankers. The research house JBC Energy was more skeptical about Brent: “In such an environment, it is as possible for Brent prices to briefly go to $10 per barrel as it was back in 1986 or 1998”.

Goldman saw negative US prices

Goldman Sachs painted the devil on the wall for the US sponsors because of the logistics costs. Chief commodity strategist Jeffrey Currie saw negative prices coming. A rural producer would pay customers to buy oil. The entire logistics chain has a relatively small storage capacity – pipelines, terminals, oil tanks, refineries, etc. can hardly take up any crude. In view of the cost of closing a borehole, however, producers would prefer to pay a premium for the offtake.

19 cents donated for a barrel of heavy oil

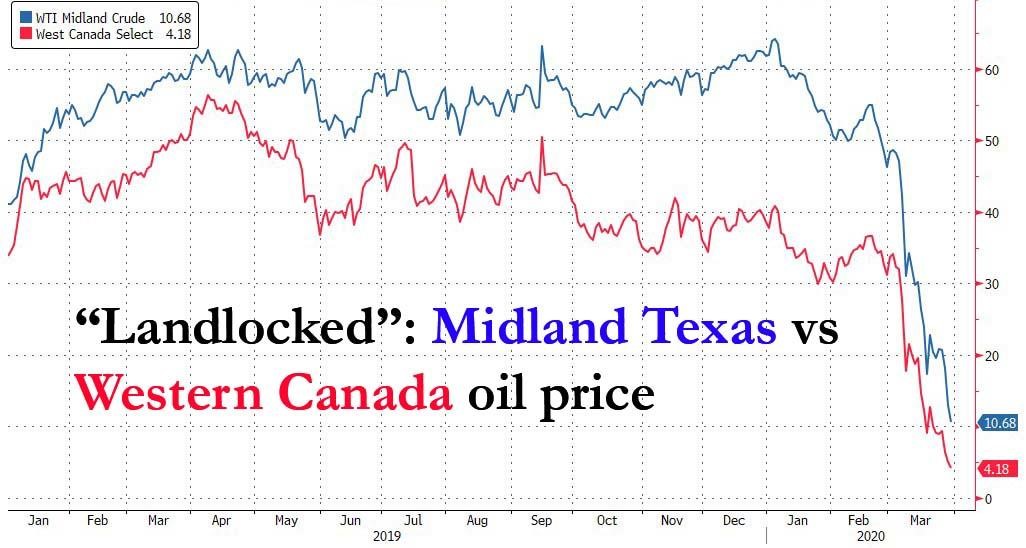

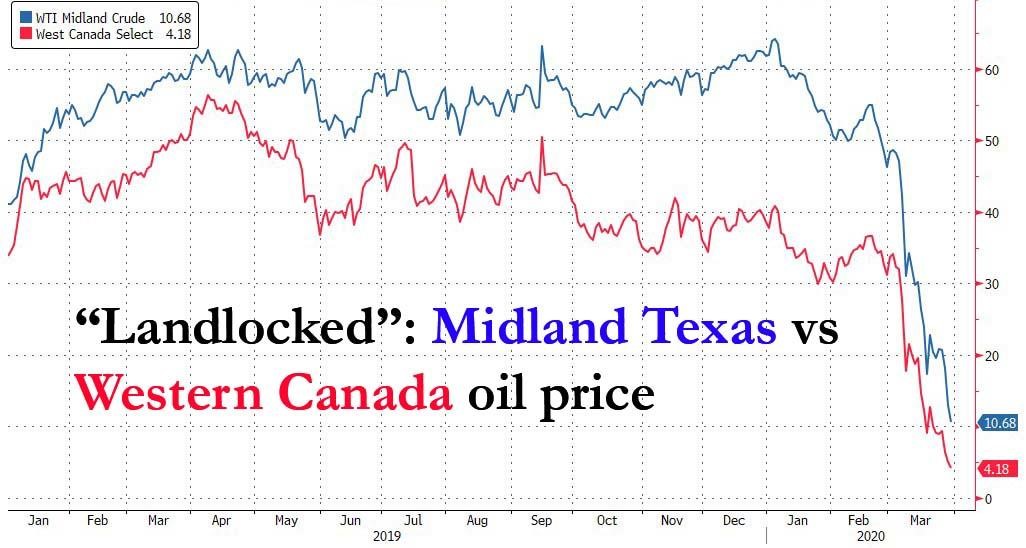

And that’s exactly how it happened. According to Bloomberg, the large trading house Mercuria offered 19 cents to buy the Wyoming Asphalt Sour, a dense heavy oil used for the production of tar. Prices in other niche markets are also sliding rapidly towards zero: Oklahoma Sour was offered for 5.75 dollars, Nebraska Intermediate for 8, and Wyoming Sweet slid to 3 dollars a barrel. And Texas Midland WTI recently traded at just $10 a barrel, according to Goldman. Oil from Canada, represented in the Canada Western Selected Index, even traded at just over $4 a barrel.

KO of the US oil industry

The industry is therefore well prepared for this. The investment bank Raymond James judged that the US oil industry will collapse at prices well below 30 dollars for WTI. Oilprice.com reported with reference to Reuters that the break-even for the US oil industry is between 39 and 48 dollars per barrel.

And this is the plan of Igor Sechin, head of the Russian oil company Rosneft. The manager with the charming nickname “Darth Vader” is the grey eminence in the Kremlin and the strongest “silovik” – a representative of the nationalist power apparatus. He is also the driving force in the price war between Russia and Saudi Arabia. About two weeks ago, Sechin said on Russian state television, according to Radio Liberty, that as soon as the American oil industry was knocked out, the price of oil would rise sharply again. He predicted 50 to 60 dollars per barrel by the end of the year. The USA had previously ousted Russia from many traditional markets in Europe and Asia.

Rosneft and Russia with staying power

Sechin added that Rosneft could keep its production at the current level for another 22 years without tapping new sources. The American sanctions had hit the US banks harder than Russia, as they were now no longer collecting interest from Russian oil producers. By the way, according to Statista, Russia is sitting on gigantic gold and currency reserves of 570 billion dollars, so the Kremlin can cope with lower energy prices for quite some time. We add: Of course, even in the gigantic Russia the oil has to be transported over long distances via pipelines or trains to the ports. But if Sechin decides to do so, then it will be done for free for a short time.

Communist trauma

Setschin’s thinking thus revolves around America – a typical trauma in Russia’s elite. Together with the Saudis, the USA caused oil prices to collapse during the Cold War, leading to the national bankruptcy of the USSR. From 1988 onwards, Sechin experienced this as an employee in the foreign department of the State University of Leningrad, a cadre forge of the KGB. From 1991 to 1996 he was Vladimir Putin’s chief of staff in the city administration of the now renamed Saint-Petersburg. Chaos raged there: the economy had collapsed, the Tambovskaya mafia was spreading. An unprecedented humiliation for the communist cadres.

The revenge of the siloviki

In 1996, Sechin moved to Moscow together with Putin in the presidential administration under Boris Yeltsin. Under Putin, the mafia went to the dogs, Moscow drastically increased its arms expenditure, oligarchs were eliminated, the oil company Yukos was destroyed and sold to Rosneft. The siloviki stabilized Russia – at the same time the oil price rose because China became a world power. And today the siloviki are paying it back to the Americans. So you should consider putting shorts on oil for a while longer – but also on the ruble. The Bernstein Bank wishes successful investments!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice.