20.05.2022 – As predicted, the war in Ukraine has led to a price explosion. But there are other factors behind the rise in prices. We shed light on the facts.

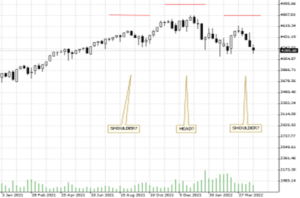

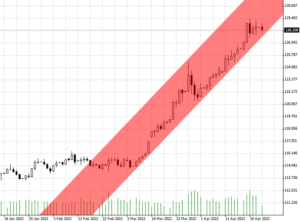

The price of wheat has just reached an all-time high – 442 euros per ton in Europe. In the U.S., the increase was smaller because of high domestic production – the daily chart shows the price in dollars, although we ask you to research the ancient unit bushel, which defies all logic, for yourself. Be that as it may: The recent small setback is unlikely to have been a real trend reversal.

Source: Bernstein Bank GmbH

This brings us to the reasons for the price development. In the long term, above all global overpopulation, which is seldom or never discussed in the truth media in this country – politically correct taboo and all that – it’s always our fault. But if in some so-called cultures women have no rights to sexual self-determination, then six, eight or ten children are the norm. With the usual consequences: Forest clearing, overfishing, overgrazing, lowering of the water table, salinization of arable land, hunger, flight to golden Europe. Where a certain German Minister of the Interior, who sometimes writes for DKP leaflets and allows herself to be photographed with antifas, is already waiting to receive them all, all.

Harvest endangered worldwide

In addition, there are some medium-term weather phenomena. About a week ago, the U.S. Department of Agriculture released a report titled “World Agricultural Supply and Demand Estimates” (WASDE). It said output was lower in Australia, Morocco, Argentina, China and the European Union (dry early summer). Bloomberg added that in the U.S., the crop was extremely poor due to drought, and in Canada, cold and wet weather also delayed sowing. India is suffering from a heat wave – incidentally, the country is the second largest exporter. The subcontinent has now imposed an export ban. Number one is China; but here floods destroyed large parts of the harvest. The number three exporter is Russia. But Moscow is denying exports to some countries because of sanctions on parts of its economy.

Blockade of Ukraine

But the current reason for the dearth is the blockade of Ukrainian Black Sea ports by the Russian Navy. According to WASDE, Ukraine’s harvest will slump by about a third this year. In addition, according to an estimate by the German Ministry of Agriculture, 25 million tons are currently stored in Ukraine – but they cannot be removed due to the war. The short-term situation could change if the U.S. delivers modern anti-ship missiles, as announced. This is to be expected, as the Americans are acting decisively – while Germany’s chancellor is ranting about a “turning point in time” and apparently backstabbing the delivery of Marder and Gepard tanks. As Reuters reports, citing White House and congressional sources, Harpoon missiles with a range of up to 300 kilometers and the Naval Strike Missile (NSM) with a range of 250 kilometers are under discussion.

Annexation and nuclear strike

Which leaves us with one more particularly ominous potential development to report in this sick war. The always well-informed Institute for the Study of War (www.understandingwar.org) recently warned that the war is now entering its decisive phase. The Kremlin is still trying to occupy as much Ukrainian territory as possible for annexation. But if the regime realizes that it is not making much headway in the face of fierce Ukrainian resistance, the Russians could dig in. And then annex the territories they already occupy in order to attack again later. These would then be Russian territories – and Moscow would regard every combat action as an attack on Russia. This would probably result in the use of nuclear weapons. Let us hope that this case does not occur. Bernstein Bank keeps an eye on the situation for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7