22.04.2022 – The Federal Reserve is getting serious: Even Jerome Powell has set investors on a more aggressive tightening course. Raising the federal funds rate by 0.5 percentage point at the upcoming May meeting “is definitely an option,” he said yesterday. Investors ran for cover.

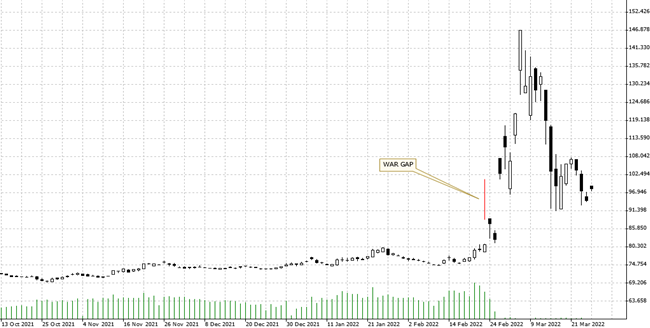

Those who had still hoped that the Fed would postpone tightening because of the threat of recession were proven wrong. At his last appearance before the Quiet Period in the course of the May Fed meeting, Powell shattered all bulls’ dreams at the International Monetary Fund in Washington, D.C.. Ergo, shareholders reacted in shock. You can see the reaction to Powell very nicely in the hourly chart of the Nasdaq 100. As always, don’t trade around the Fed. Whenever the lords of money appear in public, caution is the order of the day for traders.

Source: Bernstein Bank GmbH

At the debate in the US capital, Powell justified his stance: “the US labor market is too hot… unsustainably hot.” Such strong words are rarely heard from the rather soft Fed chief. Normally, the Fed raises interest rates by only 0.25 percentage points. But not without reason, many investors accuse the U.S. central bank of having overslept the development and being “behind the curve,” which is why it now has to proceed too drastically – we recently highlighted this topic here. In fact, with inflation at 8.5 percent, quick action is called for.

75 basis points possible

And that is precisely why there may be more to come. A few days ago, the hawkish James Bullard, head of the Federal Reserve Bank of St. Louis, expressed himself even more harshly. He even brought an interest rate hike of 75 basis points into play and hinted that the Fed could raise the key rate to 3.5 percent by the fourth quarter of 2022. Currently, that’s in a range of 0.25 to 0.50 percent.

And Mary Daly, president of the San Francisco Federal Reserve, also announced a series of rate hikes on Wednesday. In doing so, she herself accepted the risk of a recession – but that is unlikely to happen, and if it does, it will only be moderate, she said at the University of Nevada Las Vegas. So Daly is assuming a soft landing. We’re not the only ones skeptical about the worst inflation rate in 40 years.

Cash drain in the market

As it stands, a lot of liquidity is being drained from the market because of inflation. Still, that might not help the economy. That’s because we’re currently experiencing the opposite of a Goldilocks Economy, many Wall Street veterans believe. That’s a state in which Goldilocks – that is, the typical investor – is happy because the economy is running neither too hot nor too cold. That is, moderate economic growth accompanied by low inflation, which allows for market-friendly monetary policy.

Too hot and too cold

In contrast, the current economy is running too hot (inflation) in some places, such as wages and energy costs. And at the same time, it is too cold elsewhere and threatens to crash, for example in retail or the chemical industry, as well as in exports in the wake of the Ukraine sanctions (recession). The result: stagflation. Rising prices, collapsing sales, high costs for raw materials and energy, and expensive loans. All this is poison for the stock market. Bernstein Bank keeps an eye on the matter for you!

Important Notes on This Publication:

The content of this publication is for general information purposes only. In this context, it is neither an individual investment recommendation or advice nor an offer to purchase or sell securities or other financial products. The content in question and all the information contained therein do not in any way replace individual investor- or investment-oriented advice. No reliable forecast or indication for the future is possible with respect to any presentation or information on the present or past performance of the relevant underlying assets. All information and data presented in this publication are based on reliable sources. However, Bernstein Bank does not guarantee that the information and data contained in this publication is up-to-date, correct and complete. Securities traded on the financial markets are subject to price fluctuations. A contract for difference (CFD) is also a financial instrument with leverage effect. Against this backdrop, CFD trading involves a high risk up to the point of total loss and may not be suitable for all investors. Therefore, make sure that you have fully understood all the correlating risks. If necessary, ask for independent advice. CFDs are complex instruments and are associated with the high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFD with this provider. You should consider whether you understand how CFD work and whether you can afford to take the high risk of losing your money.7